-

Gap with informal market narrows thanks to depreciation

-

Convergence of two rates key to revival of confidence

For investors who doubted Zimbabwe would let market forces determine the price of its new currency, there’s some evidence it’s doing just that.

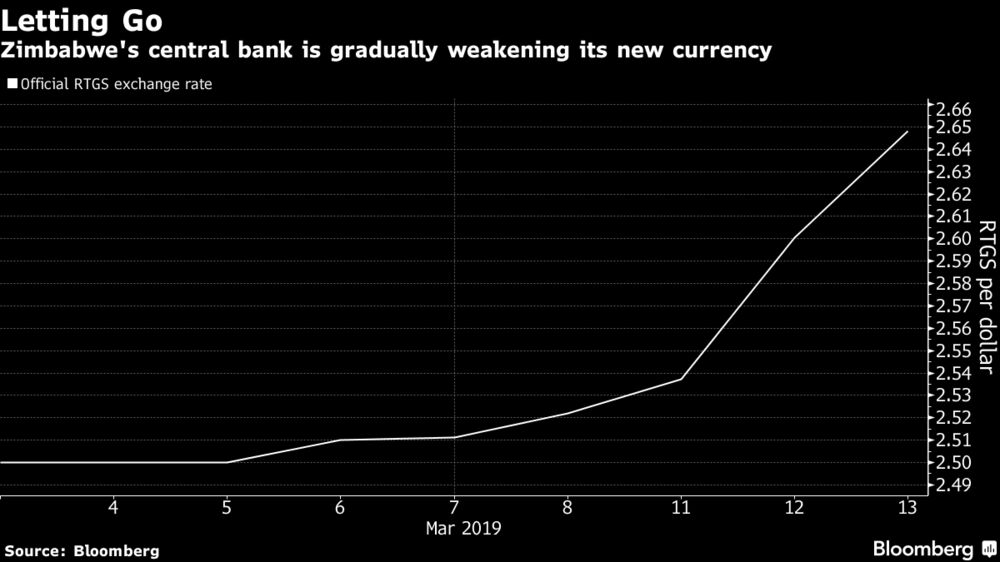

The southern African nation’s central bank has allowed the currency, known as RTGS, to slide to 2.6481 per dollar this week, taking its depreciation since trading started on Feb. 22 to 5.6 percent. That marks a change from the previous fortnight, when it was stuck at almost exactly 2.5.

There’s still a wide gap with the black-market rate of 3.55, according to marketwatch.co.zw, a website run by financial analysts in Harare, the capital. But it’s closing thanks to the latest bout of depreciation.

Investors won’t be satisfied the country’s dire shortage of foreign exchange — which has destroyed the economy and led to shortages of bread and fuel — is over until the two rates converge.

RTGS, which stands for real-time gross settlement, was the result of the central bank’s decision years ago to print an electronic version of real dollars to fund rampant government spending. Hyperinflation forced the nation to abandon its original currency in 2009.

For long, the government and central bank insisted that RTGS had the same value as greenbacks, even as it plummeted in the black market. Officials relented last month by opening a formal interbank market for RTGS.