I always doubted Zimbabwe would be a reliable mining destination, but the country has so far behaved very well toward Caledonia Mining.

Despite elevated capex (which will reduce costs and increase production), the company will remain free cash flow positive.

80,000 ounces of gold at a sub-$1000 AISC from 2022 on could indicate the $200M EV company could be re-rated (despite the Africa-discount).

Looking for a portfolio of ideas like this one? Members of European Small-Cap Ideas get exclusive access to our model portfolio. Get started today »

Introduction

I have known Caledonia Mining (CMCL) for the better part of the past decade, but I never dared to buy the stock as I didn’t trust the country of Zimbabwe, where Caledonia’s producing mine is located.

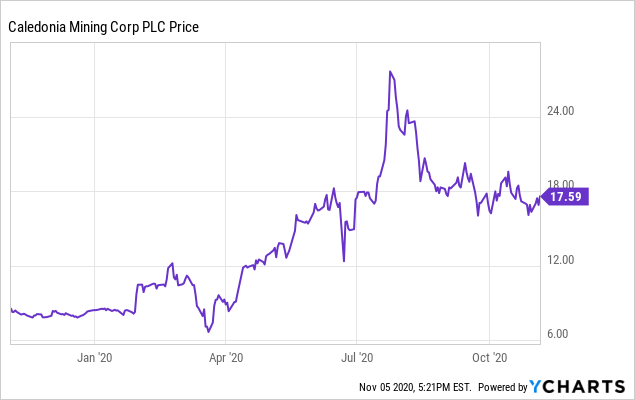

Data by YCharts

Data by YChartsWaiting for Q3, but looking back at Q2, the expectations are high

In the second quarter of the year, Caledonia Mining produced 13,499 ounces of gold, a slight decrease from the just over 14,000 ounces that had been produced in the first quarter of the year, and this pushed the total H1 production to 27,700 ounces of gold. Not bad at all, and whereas small mines usually have a disadvantage as they cannot unlock sufficient economies of scale, Caledonia Mining actually performed very well.

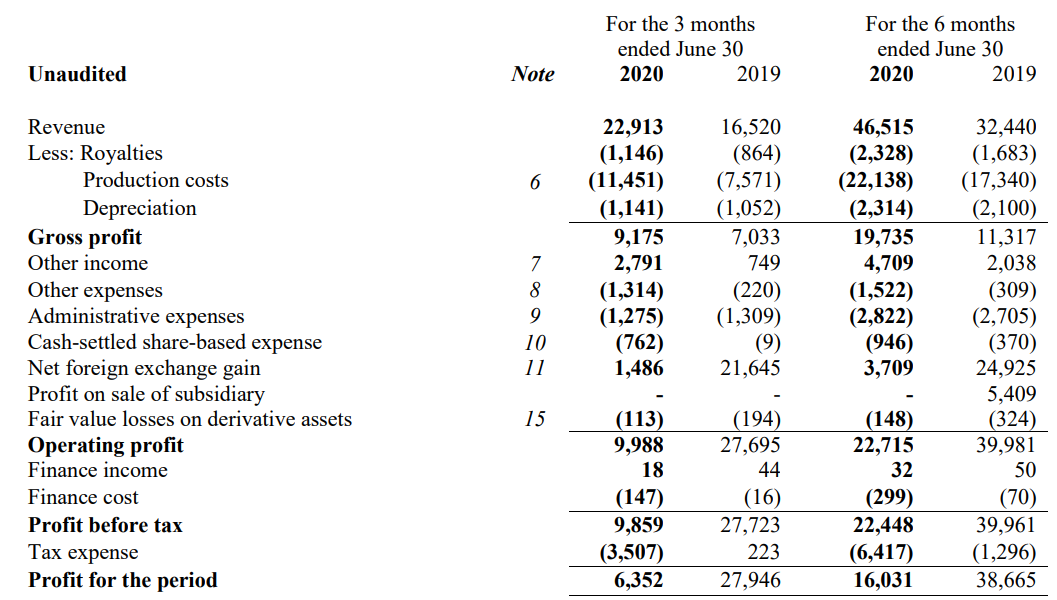

The total revenue in the first half of the year came in at $46.5M, and after making the relevant payments for royalties and covering the pure production costs, the gross profit (which also includes depreciation) came in at $19.7M, an increase of almost 80% compared to the first half of 2019, thanks to the much higher gold price.

Source: financial statements

The net income in the first half of the year came in at $16M, but this also included a FX gain of $3.7M so rather than just taking the net income at face value, I wanted to dive deeper into the cash flow statement to figure out how much cash the company was effectively generating.

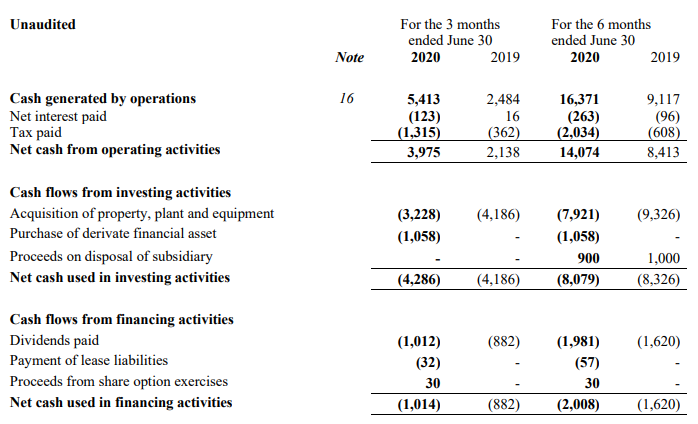

According to the cash flow statement, the net operating cash flow was $14.1M, but it looks like this underestimates the total tax bill by $4.4M, and starts from a “cash generated by operations,” as you can see below.

Source: financial statements

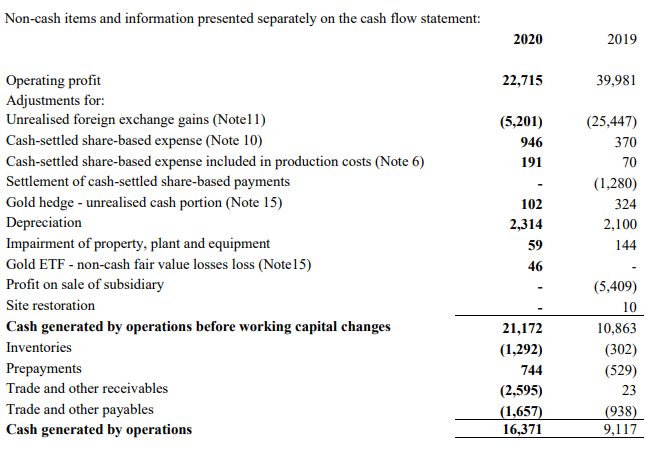

That usually means the footnotes provide more information as there will undoubtedly be some changes in the working capital position as well. And indeed, according to the relevant footnote, the operating cash flow before working capital changes was almost $21.2M, $4.8M higher than the reported cash generated by operations.

Source: financial statements

This means the adjusted operating cash flow, corrected for working capital changes and the tax bill, actually remains virtually unchanged at around $14M. With a total capex of almost $8M, the free cash flow result was around US$6M. The average gold price in the first semester was just under$1630 per ounce.

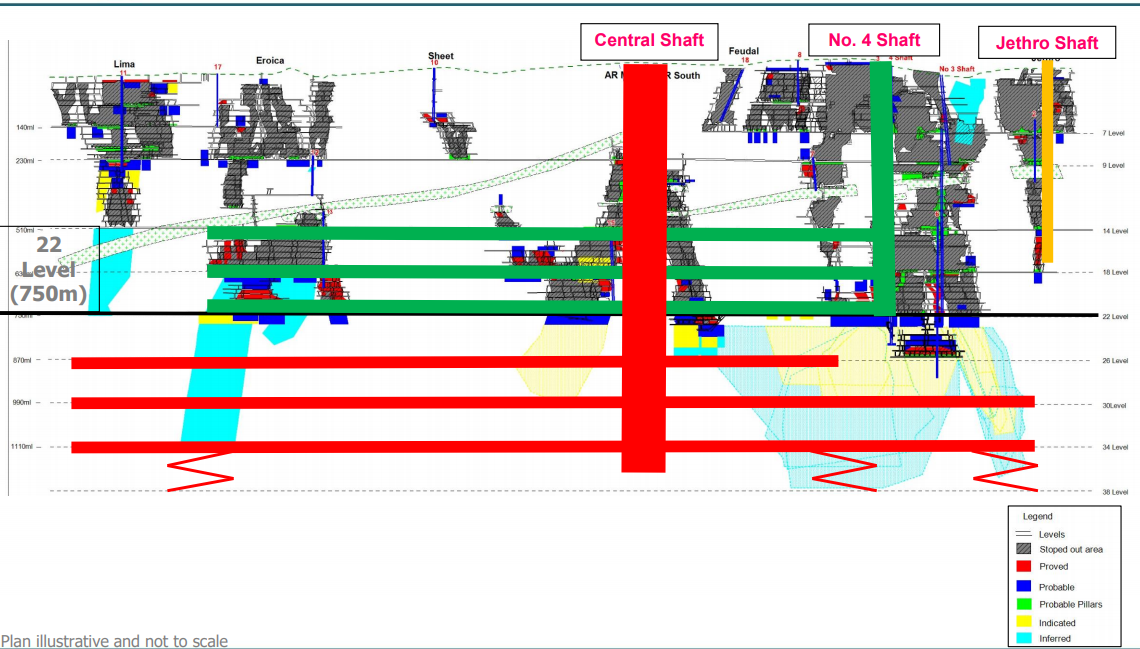

You shouldn’t be alarmed by the high capex, as this is related to the construction of the Central Shaft. This new shaft will be commissioned by the end of this year and will improve access to mineable zones deeper than 750 meters, thus securing the mine life for in excess of an additional decade. Once the Central Shaft has been completed, the capex will decrease very fast while the output will increase towards the 80,000 ounces per year from 2022 on.

Source: company presentation

As you can see, the operating and financial performance in the first half of the year was very satisfying, but I expect the third quarter to be even stronger. The total production in Q3 was 15,164 ounces of gold (an 11.1% increase compared to Q3 2019), which compares nicely to the 27,700 ounces produced in the first half of the year. Caledonia Mining also is guiding for a full-year production of 55-58,000 ounces of gold and reaching the mid-point of this guidance would indicate a Q4 production of around 14,000 ounces of gold as well. Meanwhile, Caledonia also has confirmed its production target of 80,000 ounces of gold for 2022.

The balance sheet is rapidly improving, and the company is trying to build its working relationships in Zimbabwe

Despite spending money on the Central Shaft, Caledonia Mining still had plenty of money available to increase its net cash. As of the end of December 2019, the company had $9.4M in cash and just $2.4M in debt for a net cash of $7M. By the end of June, the cash pile increased to $11.6M while the total debt decreased to $0.7M for a net cash of just under $11M or almost US$1/share. I expect the net cash to have increased to in excess of $15M as of the end of September.

The stronger balance sheet and the increased confidence in Zimbabwe as a mining destination allowed the board of directors to sign off on a $12M solar plant, which will cover 27% of the total power demand from the plant. The solar plant should be operational in 2021, and I would expect this to help reduce the operating expenses at the mine.

Investment thesis

I have no position in Caledonia Mining as I was unsure about Zimbabwe living up to its commitments to not interfere in the gold mining operations. I was wrong, and Zimbabwe has shown to be a relatively reliable host country. In fact, Caledonia Mining is working on adding more assets in the country.

I still don’t have a long position in Caledonia Mining but at an enterprise value of less than $200M and a gold price exceeding $1900/oz, I’m getting interested.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

NEW at ESCI: A dedicated EUROPEAN REIT PORTFOLIO!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.