A raft of new taxes and increases announced as part of Zimbabwe’s 2024 budget by Finance Minister Mthuli Ncube has been widely condemned.

The increase in passport fees to $200 (£160), up from $120, making it the most expensive in the region, seems to have provoked the most ire.

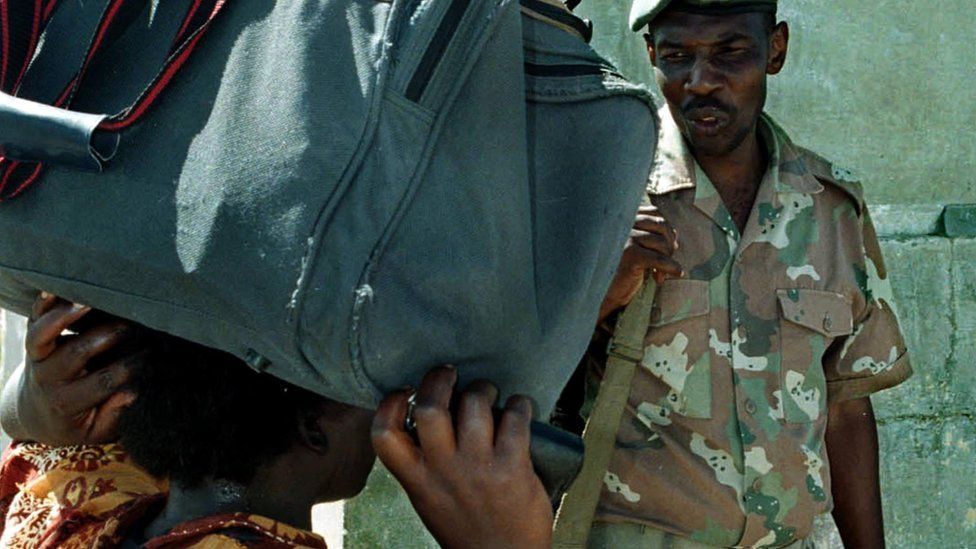

Amid Zimbabwe’s economic collapse, many people survive by doing cross-border trade.

So for them, a passport is a vital tool of their trade.

Passports are also in high demand as many Zimbabweans are desperate to leave the country and seek work elsewhere.

Economists estimate unemployment in Zimbabwe is as high as 85%.

Many of those not formally employed make a living by travelling, primarily to South Africa, to buy goods unavailable or too expensive in Zimbabwe, for resale.

Dubai and Turkey are favoured destinations by those with more money.

Mavis Chiangwa travels to South Africa regularly to buy spare parts for cars for sale in Harare.

Although her passport is still valid for another five years, she feels the proposed hike is too much: “The 67% increase is too high and will make it difficult for those wanting to apply for new passports or those renewing,” she told the BBC.

But the increase in passport fees was just one of several hikes proposed by Mr Ncube, who needs to increase government revenue in order to reduce the amount of money the state needs to borrow.

A 1% wealth tax will be levied on residential properties with a minimum value of $100,000. Private residential properties owned by those above 70 are exempt.

Toll fees will increase by more than 100% on the country’s two busiest highways and 100% on all other roads from 1 January.

A fuel strategic reserve levy will see motorists paying an additional three and five cents per litre of diesel and petrol respectively.

Critics of these increases argue they will hit those who use public transport hardest as transport operators will pass on the new costs.

Mr Ncube also proposes a tax of two cents per gram of sugar in soft drinks saying: “It’s necessary to discourage consumption of high-sugar content beverages.”

He promised that the money raised would be ring-fenced for cancer therapy and to buy diagnostic equipment.

Economists are highly critical of the proposed increases and new taxes.

Professor Gift Mugano has urged parliament to reject what he called the “anti-people and anti-industry” budget.